I've been watching the crypto space for years, and one pattern keeps repeating: DeFi advocates claim they're building the future of finance while fundamentally misunderstanding what finance does. The "trustless" revolution isn't disrupting traditional finance. It's building something that can never be finance.

DeFi removes recourse, recovery, and accountability—the core value of finance. Trust is the product, not the bug. Run the red flag audit before committing funds: multi-sig, audit history, oracle protection, legal entity. Three red flags = assume total loss.

Updated January 2026: Added recent DeFi security incidents including the Yearn Finance and Unleash Protocol hacks from late 2025.

The logic is sound on paper. The problem is that over $3 billion was stolen from DeFi protocols in 2022 alone, and roughly 95% of stolen funds are never recovered.

This isn't about whether blockchain technology works. I've written about why blockchain is mostly a solution looking for a problem. DeFi is different. It works as designed. The problem is what it's designed to do. After watching these systems for a decade and advising startups in the space, the pattern is clear: they're solving a problem that nobody actually has.

What Finance Actually Does

The crypto community often frames traditional finance as a collection of middlemen extracting rent. Banks, brokers, clearinghouses - parasites on capital flows. DeFi promises to eliminate them through trustless protocols.

This misses what finance actually provides:

Recourse. When something goes wrong - and something always goes wrong - you have someone to call. Fraudulent charges get reversed. Disputes get arbitrated. Contracts get enforced. This isn't a bug. It's the system.

Recovery. Forgot your password? Lost your card? Got scammed? Traditional finance has processes for all of this. Imperfect processes, often frustrating, but processes that exist because humans make mistakes and bad actors exist.

Accountability. Banks are regulated. Brokers are licensed. When institutions fail, there are consequences - sometimes inadequate, but real. Someone is responsible. Someone can be sued.

Insurance. Your deposits are insured. Your investments have protections. The system is designed to absorb failures rather than pass them entirely to individuals.

DeFi's "trustless" model explicitly removes all of these. That's not a feature - it's abandoning the parts of finance that make it finance.

The Numbers Don't Lie

The DeFi experiment has been running long enough to generate data. The data is damning.

According to Halborn's Top 100 DeFi Hacks Report, crypto hacking losses hit $3.95 billion in 2025 alone. By mid-July 2025, losses had already exceeded all of 2024. The first quarter of 2025 was the worst on record, with Immunefi estimating $1.64 billion stolen in just three months.

Historical losses from top DeFi exploits exceed $10.77 billion cumulatively. That's not market volatility. That's money gone through smart contract exploits, bridge attacks, and protocol failures.

The 2025 hack of Bybit resulted in approximately $1.5 billion in losses from a single incident. The Cetus DEX hack in May 2025 cost around $223 million because of a missing overflow check. A single line of buggy code.

These aren't edge cases. According to security researchers, about 70% of smart contracts on Ethereum are inactive or vulnerable. The attack surface isn't shrinking - it's growing with every new protocol.

Audited, Tested, and Still Broken

The DeFi community's response to security failures has been: "Get audited." The track record suggests this doesn't help.

As one security analysis of 2025 hacks documented, protocols that passed multiple audits still fell victim to attacks. Yearn Finance, one of the most established DeFi protocols, suffered two related exploits in December 2025 targeting legacy infrastructure.

Traditional audits aren't enough. They can't assess interactions with oracles, APIs, market conditions, and governance mechanisms. The complexity of DeFi protocols means the attack surface extends beyond what any audit can cover.

Only 19% of hacked protocols used multi-sig wallets. Just 2.4% employed cold storage. Basic security practices that traditional finance takes for granted are absent from most DeFi infrastructure. This is the same pattern I described in why crypto is bad - the technology ignores operational reality.

DeFi Red Flag Audit

Before putting money into any DeFi protocol, check these basic security indicators:

The response from DeFi advocates? "The technology is still early." After eight years and tens of billions in losses, "early" starts sounding like "inherently broken." I've built production systems - in my experience, "still early" after this long usually means the fundamental architecture is wrong.

The Oracle Problem Never Got Solved

Smart contracts can only access data on the blockchain. Real-world information - asset prices, weather, delivery confirmations - has to be fed in by "oracles." This creates a fundamental contradiction in the "trustless" promise.

If you trust an oracle to provide accurate data, you've reintroduced the trusted third party you were trying to eliminate. The smart contract is only as trustless as its data sources. Oracle manipulation has caused hundreds of millions in losses.

Flash loan attacks accounted for 83.3% of eligible exploits in 2024. They work by manipulating oracle prices. The attacker borrows funds, distorts a price feed, exploits a protocol that relies on it, and repays the loan - all in a single transaction.

Flash Loan Attack Mechanics

Here's exactly how these attacks work—in a single Ethereum block (~12 seconds):

- Borrow. Attacker takes flash loan of $10M from Aave. No collateral required—repayment is enforced atomically.

- Manipulate. Use $10M to buy Token A on a DEX with thin liquidity. Price spikes 50x.

- Exploit. Target protocol's oracle reads manipulated price. Protocol now believes attacker's Token A is worth $500M.

- Extract. Borrow against the inflated "collateral." Protocol releases $50M in stablecoins.

- Repay. Return original $10M flash loan plus 0.09% fee.

- Profit. Attacker keeps ~$40M. Protocol is insolvent. Users are ruined.

Total time: 12 seconds. Total transactions: 1. Reversibility: zero. I've watched smart engineers lose savings to DeFi exploits that traditional finance would have prevented with basic price circuit breakers.

Traditional finance has intermediaries precisely because someone needs to verify information and bear liability for errors. DeFi's answer - "trust the code" - fails when the code trusts the wrong inputs.

Immutability Is a Liability

Blockchain's immutability is supposed to be a feature. Once deployed, smart contracts can't be changed. The rules are permanent. No one can manipulate them.

In practice, this means:

- Bugs are permanent. Every vulnerability you ship lives forever. You can deploy a new contract, but the old one - and its flaws - remain.

- Upgrades create attack surfaces. Yearn's 2025 exploits targeted legacy infrastructure from previous versions. Upgrades don't eliminate old code - they add new code while leaving old attack vectors intact.

- No error correction. Sent funds to the wrong address? They're gone. Contract interaction didn't work as expected? Too bad. Traditional finance's ability to reverse errors isn't a weakness - it's essential.

- Regulatory compliance is impossible. GDPR requires the ability to delete personal data. Sanctions compliance requires freezing assets. An immutable system can't comply with laws that require mutability.

Real finance needs the ability to correct mistakes, enforce regulations, and respond to changing circumstances. Immutability prevents all of this.

The Institutional Money Isn't Coming

DeFi advocates often argue that institutional adoption is imminent. The infrastructure is ready. The yields are attractive. The technology is mature.

Research from Sygnum Bank tells a different story. Institutional investors aren't moving into DeFi because legal enforceability of crypto assets and smart contracts is still unclear.

Their mandates don't allow exposure to unresolved legal or regulatory risk. Even when DeFi yields look attractive, the risk-adjusted returns aren't compelling enough for institutions weighing operational and legal risk.

This isn't conservatism for its own sake. It's recognition that finance without legal recourse isn't finance - it's gambling with extra steps.

When "Decentralization" Meets Reality

The decentralization promise has also failed to materialize. Bitcoin mining is dominated by a handful of pools. Exchange volume concentrates in a few platforms. When Binance has a problem, the whole market feels it. We saw the same dynamic play out with the NFT market collapse.

The zkSync airdrop exploit in April 2025 happened because an admin key was leaked. An attacker triggered the sweepUnclaimed() function and minted 111 million tokens. So much for trustless.

The Unleash Protocol hack in December 2025, which cost $3.9 million, exposed how critical governance flaws undermine supposedly decentralized projects. When governance is concentrated, "decentralized" is just marketing.

What we have isn't decentralization. It's a poorly regulated parallel financial system with different power concentrations and fewer consumer protections.

Trust Is the Product

Here's what DeFi advocates miss - and I learned this working with financial systems over my career: trust isn't a bug in traditional finance. Trust is the product.

When you deposit money at a bank, you're not just storing value. You're buying trust - trust that the money will be there when you need it. Trust that mistakes can be fixed. Trust that the institution will exist tomorrow.

DeFi's 'trustless' model removes this product entirely. You don't have to trust anyone because no one is responsible. That's not better. That's abandoning the core value proposition of financial services.

Yes, traditional institutions sometimes fail that trust. Banks collapse. Fraud happens. But the response to imperfect trust isn't no trust. It's better trust. Regulation, insurance, legal accountability, transparent governance. These improve trust rather than eliminate it.

DeFi is the purest expression of that harm: a system that removes human judgment, accountability, and recourse from financial transactions and calls the result progress.

The Violence Monopoly

Here's the legal reality that makes "Code is Law" a fantasy:

"Code is Law" works fine until someone steals $10 million. Then you call the police—men with guns. The state's monopoly on legitimate violence is what makes contracts enforceable.

The Reality: Finance is not about math. It's about trust enforced by the state. Banks work because if they steal your money, courts will punish them. Smart contracts have no such enforcement mechanism. DeFi tried to replace "Trust in the State" with "Trust in the Buggy Smart Contract."

The Result: DeFi became a casino for people who couldn't get a bank account, not a replacement for the bank. You cannot code away the need for a legal system. When someone exploits a smart contract, there's no court to appeal to, no regulator to complain to, no sheriff to call. The code executed as written. That's not a feature—it's abandoning the foundation that makes financial systems work.

Every functioning financial system in history has been backed by state power. There are no exceptions.

When DeFi Works

I'm not saying DeFi is always wrong. Within its native domain, some applications function as designed:

- Decentralized exchanges for crypto assets. If you already hold crypto and want to swap tokens, DEXs like Uniswap work. You're trading one speculative asset for another without custodial risk. The trust assumptions match the use case.

- Lending pools for crypto collateral. Borrowing against your crypto holdings to avoid taxable events has legitimate use. Aave and Compound serve this purpose for people already committed to the ecosystem.

- Hybrid CeFi/DeFi models. Projects that combine on-chain settlement with off-chain compliance and custody may thread the needle. Traditional finance handles recourse; blockchain handles transparency.

But notice what these have in common: they serve people already in the crypto ecosystem, trading crypto for crypto. The moment you need to touch the real economy - mortgages, payroll, insurance - you need the trust infrastructure DeFi explicitly removes.

The Bottom Line

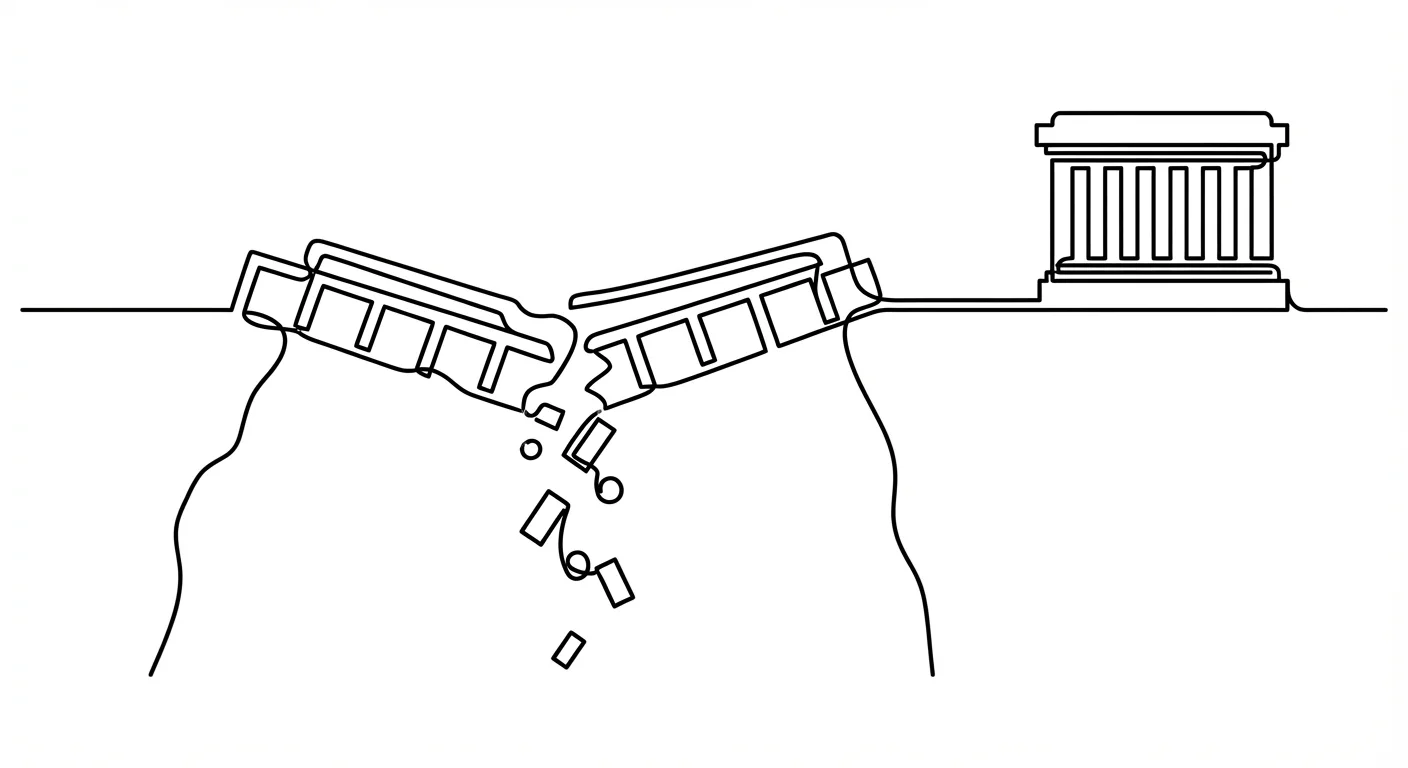

DeFi is unlikely to become real finance because it's designed to remove what finance provides. Real finance is trust, recourse, accountability, and the ability to fix mistakes. DeFi removes all of these in favor of "trustless" protocols that have lost tens of billions.

The technology works exactly as designed. The design is the problem. Finance isn't about eliminating intermediaries. It's about creating accountability. When everything is trustless, no one is responsible. And when no one is responsible, you don't have finance.

You have code running on servers, moving tokens around, occasionally getting exploited. That's not the future of finance. It's an expensive demonstration of why trust and human judgment exist in the first place.

"DeFi's 'trustless' model removes this product entirely. You don't have to trust anyone because no one is responsible. That's not better. That's abandoning the core value proposition of financial services."

Sources

- Halborn: Top 100 DeFi Hacks Report 2025 — Comprehensive analysis of DeFi security incidents

- Coinmonks: Audited, Tested, and Still Broken — Community analysis of 2025 audit failures (corroborates Halborn data)

- Sygnum Bank: Institutional DeFi in 2025 - The Disconnect — Why institutional money stays away

- CoinLaw: Smart Contract Security Risks and Audits Statistics 2025 — Security vulnerability data

- DeepStrike: Crypto Hacking Incidents Statistics 2025 — Loss totals and trends

Technology Assessment

Evaluating blockchain or DeFi solutions? Get perspective from someone who's been skeptical since 2018.

Get Assessment